Share this

Blockchain is a unique ecosystem where its participants conduct financial transactions in a zero-trust environment. It means that whoever you want to sell crypto or buy crypto from could be a bad actor. That’s why it’s important to be properly protected and have your assets secured. If someone hacks your wallet, your connection to a blockchain is lost, and consequently, you lose all your assets.

Moreover, it’s important to stress this out because the global crypto user rate is growing. In 2022, it was around 4.2%. In 2023 it’s believed to be 8,8%. By 2027 it’s expected to be 12,5%.

Whoever provides secure and robust crypto wallets will attract the growing blockchain audience and assist in the development of the blockchain ecosystem in general.

Crypto Wallet Is a Gate to Web3

When we use the phrase ‘crypto wallet’, some people think that it stores digital assets and when you need you can easily withdraw them. It’s not true, because, unlike the web2, web3 digital wallets are only gateways to blockchains.

They store the records of the blocks your assets are written in. If you think of an image, the blockchain and the crypto wallet act as a door keyhole and the key to open it. That’s why the question of who has custody of the key is utterly important.

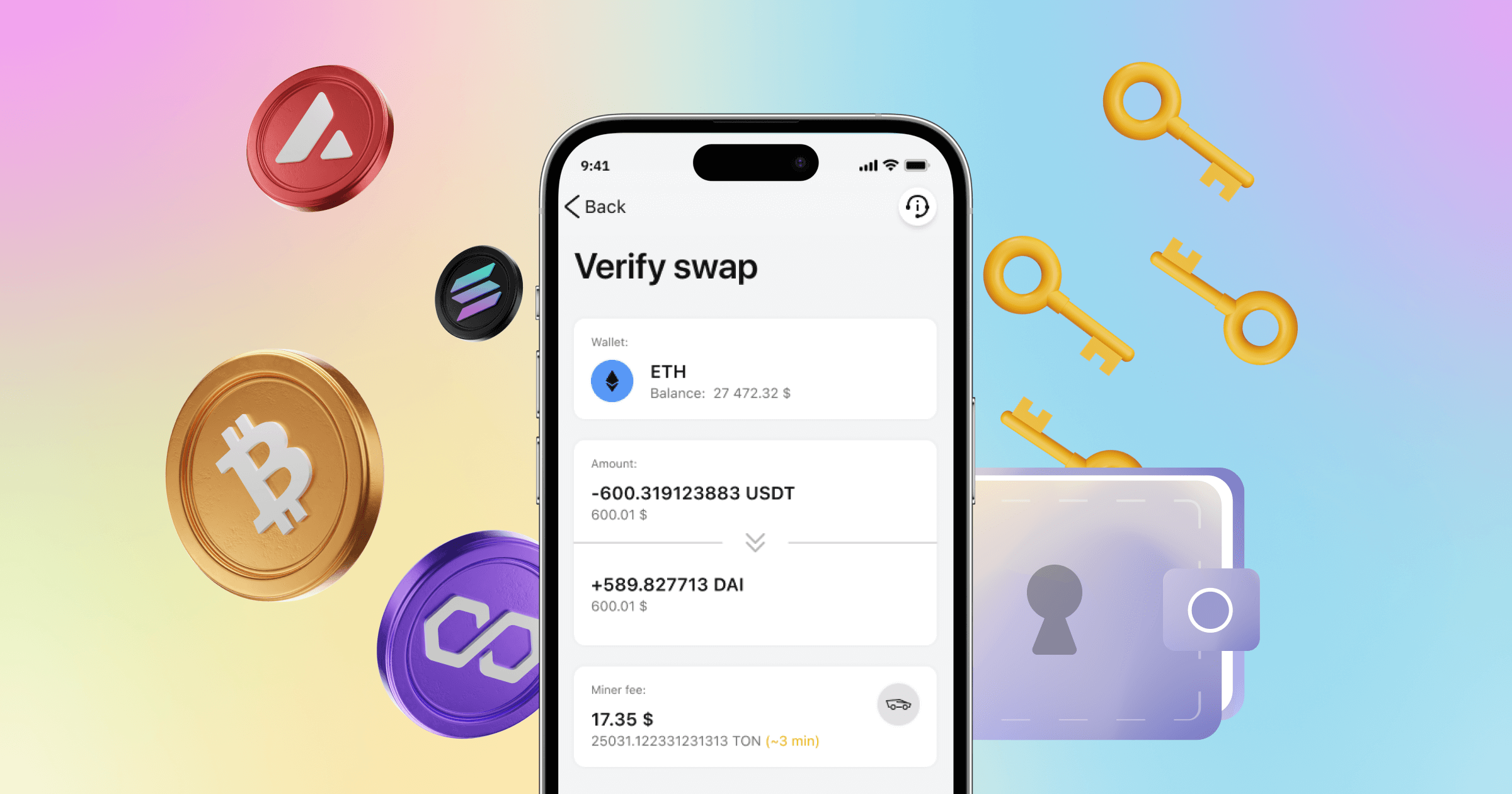

Powerful cryptography ensures that the right key opens the right door. Wallets operate through the generation of private keys which are used to sign transactions. And as long as the interaction between the wallet and blockchains is efficient, your digital assets are reachable and secure.

Due to this, crypto wallets are hard to hack. We can compare them to the knight’s armor bravely protecting its owner from malicious attacks and the enemy’s arrows. But as with any armor, it’s pretty difficult to put on. That’s why knights welcomed the assistance of their servants.

To operate wallets in a hostile zero-trust blockchain environment, you need a reliable partner who can shoulder all the wallet developmental issues and let you grow your business.

Private Key Storage Types Explained

One of the first crypto wallets was specialized hardware devices, aka cold wallets. Based on the crypto custody type, such wallets are non-custodial which means secure. The only problem is that only tech-savvy users can use them. Moreover, if something happens to the equipment: it gets lost or broken, your assets are lost.

Later online wallets appeared. Anyone could install and use them from a computer or smartphone (desktop, web, and mobile), aka hot wallets. But even this step didn’t make them easier to operate due to exceptionally advanced and complicated cryptography which caused cumbersome private key generation.

Regarding the kind of crypto custody applied, hot wallets could be custodial and non-custodial, based on their technical characteristics.

Putting all the cryptographic functions on the side of service providers called to life custodial wallets when users gave away the right to operate them to the service provider, usually a centralized exchange. That was a very successful move until one by one exchanges got hacked and brought wallet owners to bankruptcy.

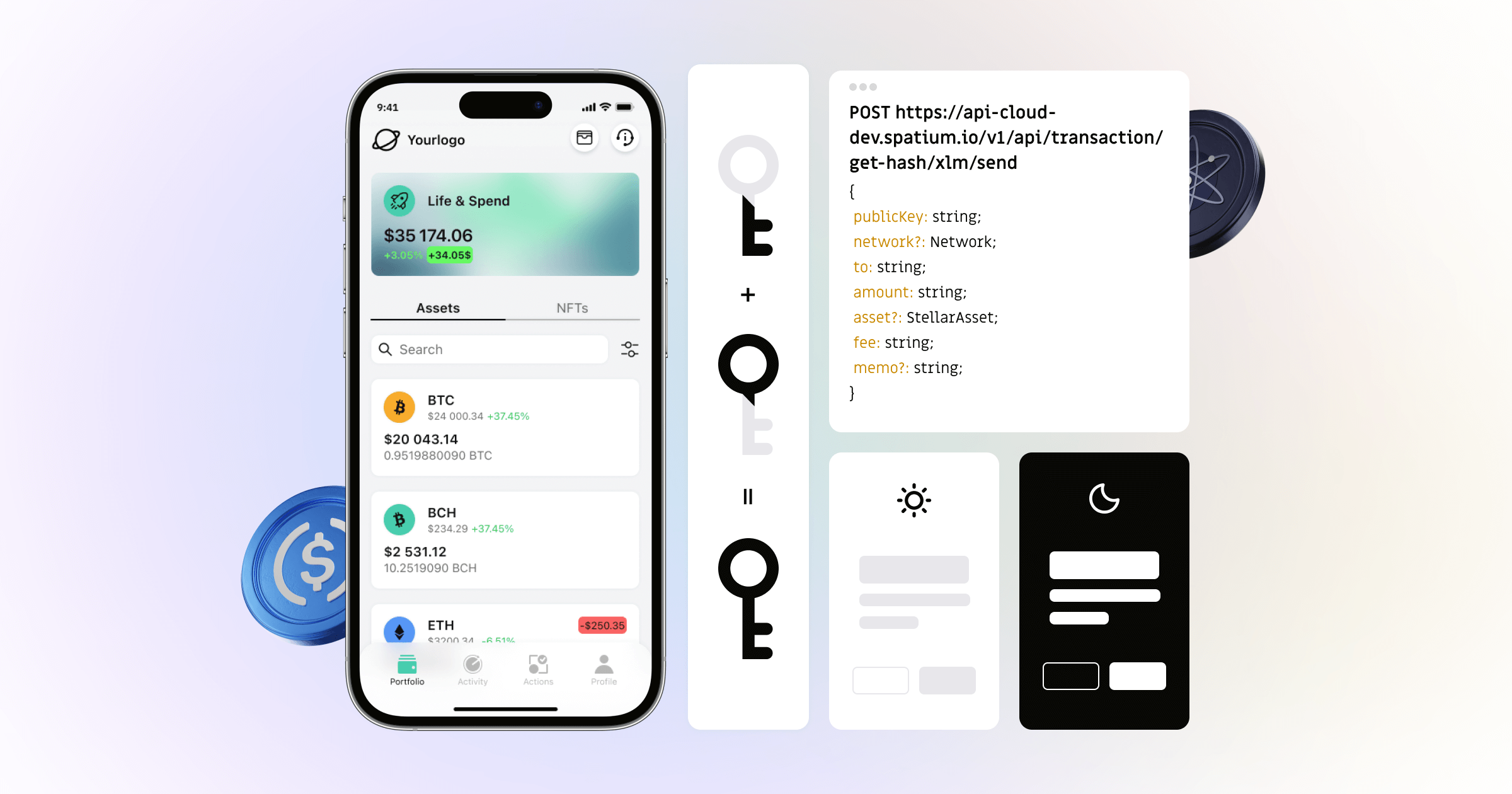

Right now, we are witnessing the rise of self-custodial (non-custodial) wallets which is the new acceleration in the crypto custody solutions space that harnesses the power of encryption and makes the wallet UX engaging and convenient for all types of users. These are MPC-powered wallets giving businesses and users full ownership over their digital assets and eliminating a single point of failure.

Let’s discuss the main two types of crypto custody solutions in detail and see how they could be beneficial for your business.

Custodial Solutions

If businesses or users delegate private key generation and storage to any third party, such wallets are called custodial. Institutional crypto custody wallets are often provided by centralized crypto exchanges, banks, etc. which operate them, store private keys, sign transactions, etc.

Benefits of Custodial Crypto Wallets

1. Friendly User Interface

Such custodial solutions are practical and easy to use. There is no need for users to store private keys, backup phrases, etc. When users want to access their wallets, they simply log in to their accounts and enjoy a similar web2 experience.

2. Security and Insurance

Wallets providing institutional crypto custody on the one hand are more secure because users cannot lose their private key as they simply don’t have access to it. On the other hand, many custodial wallet service providers offer insurance against the loss of assets. Anyway, in case of a malicious attack businesses who operate custodial wallets lose everything.

3. Customer Support

Centralized exchanges are offering their customers assistance and client services. In case users have some difficulties with their wallets or find some operations hard to fulfill, they may contact customer support and get answers to any questions they have. This is particularly beneficial to inexperienced users.

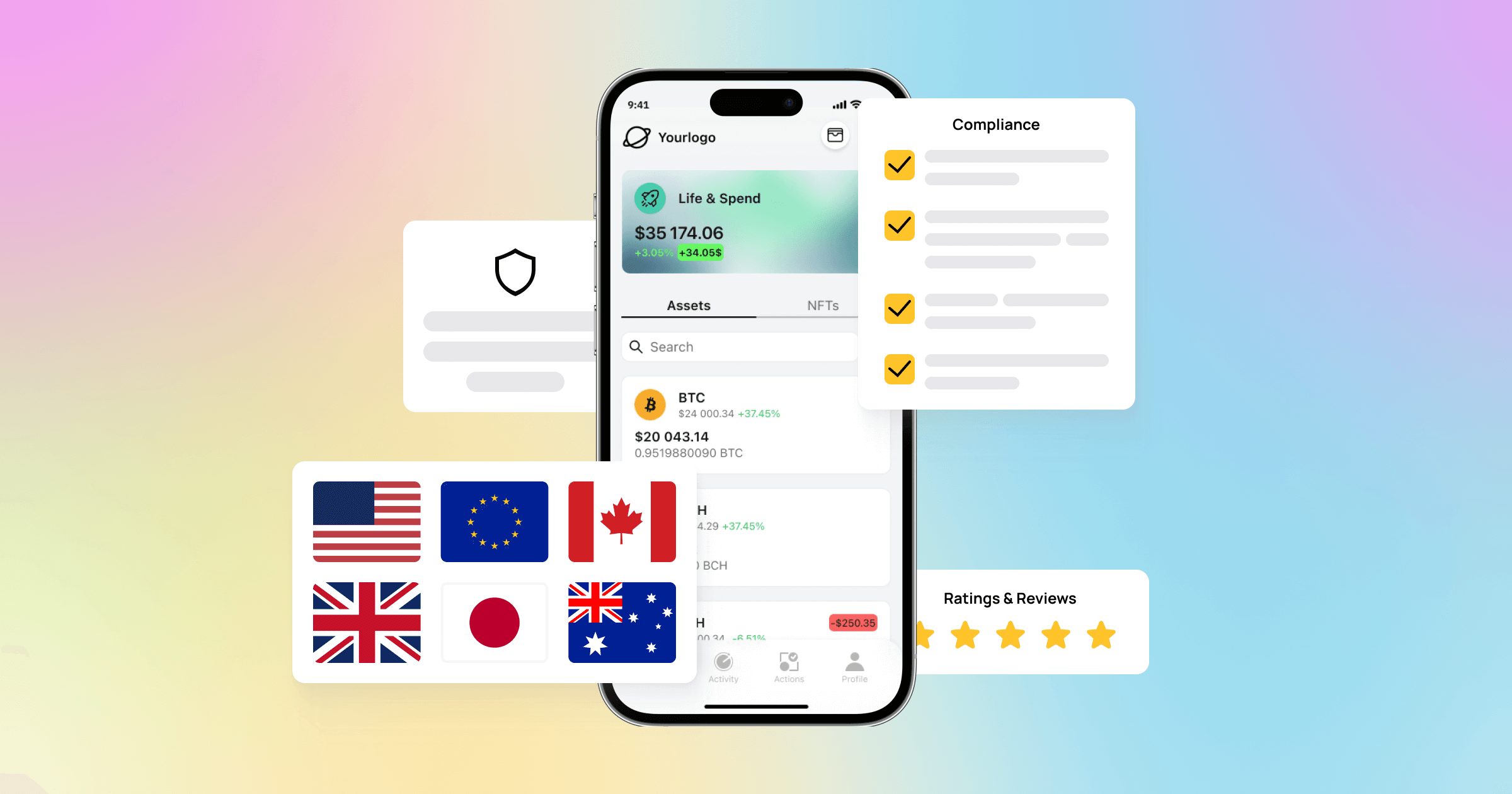

4. Alignment with Regulations

One of the reasons to choose such a kind of crypto custody solution like custodial wallets is their adherence to the standards. Centralized exchanges are governmentally registered and follow national strict security procedures.

These could be KYC, AML, or KML. Because of such practices, custodial solutions offer more transparency and accountability which could be a benefit for your business.

5. Small Fees

Based on the fact that custodial solutions are usually offered by cryptocurrency exchanges, they let users benefit from reduced gas fees while making financial transfers between the wallet and the exchange account. In addition, some other financial operations could be charged less by custodial wallet service providers as well as beneficial for those who would like to boost earnings.

Self-custodial Solutions

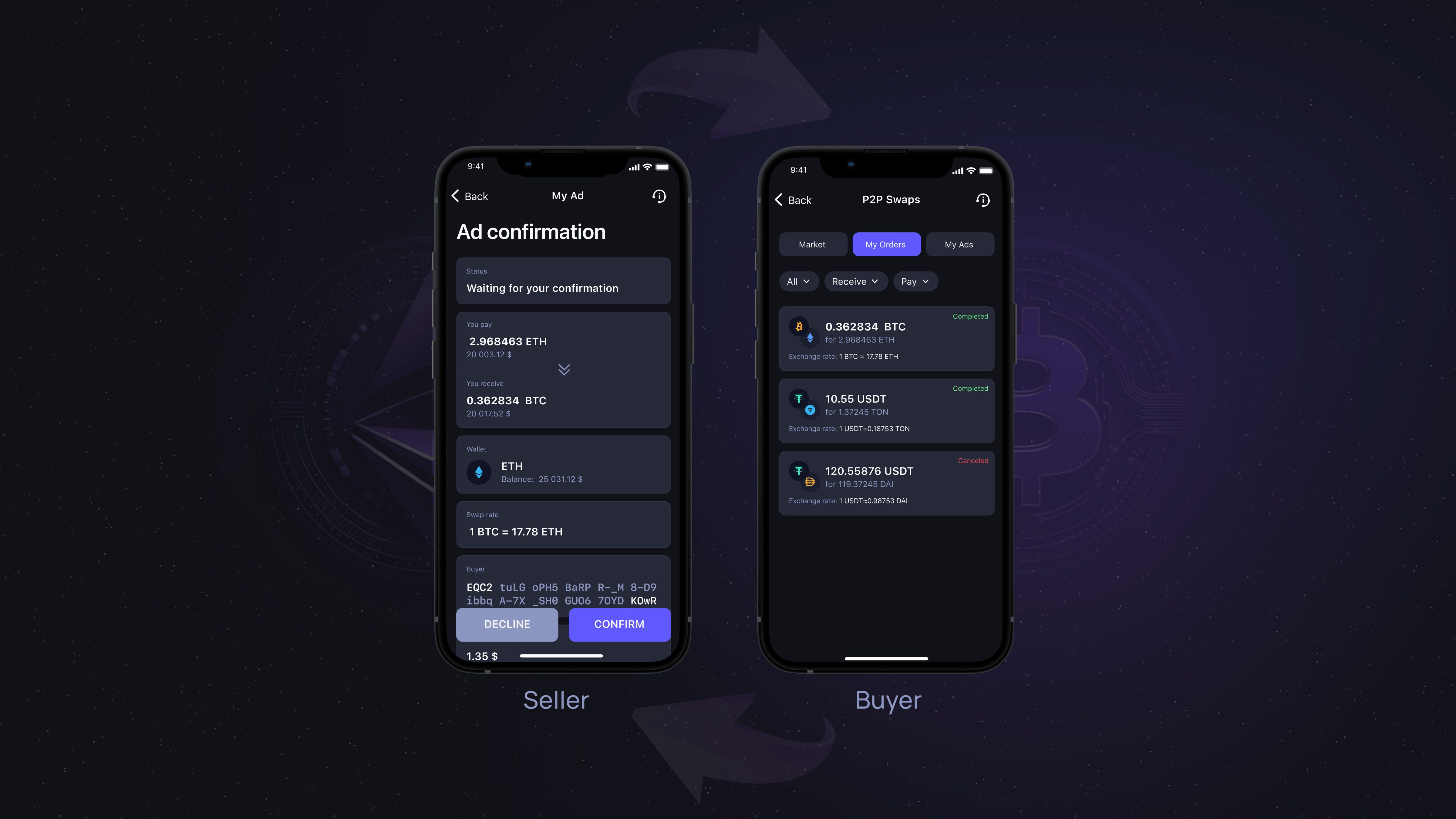

A wallet that gives full control over the private key generation and storage to the user is called self-custodial or non-custodial. These could be a variety of wallets: cold wallets, multi-sig wallets, and MPC wallets. Though all of them provide users with access to private keys, not all of these wallets are user-friendly.

Let’s concentrate on the benefits of MPC self-custodial wallets as that’s the only type of non-custodial solution that is convenient and engaging enough to attract users of all types and enable them to reap the benefits of the blockchain ecosystem.

Benefits of Self-custodial Crypto Wallets

1. Enhanced Security

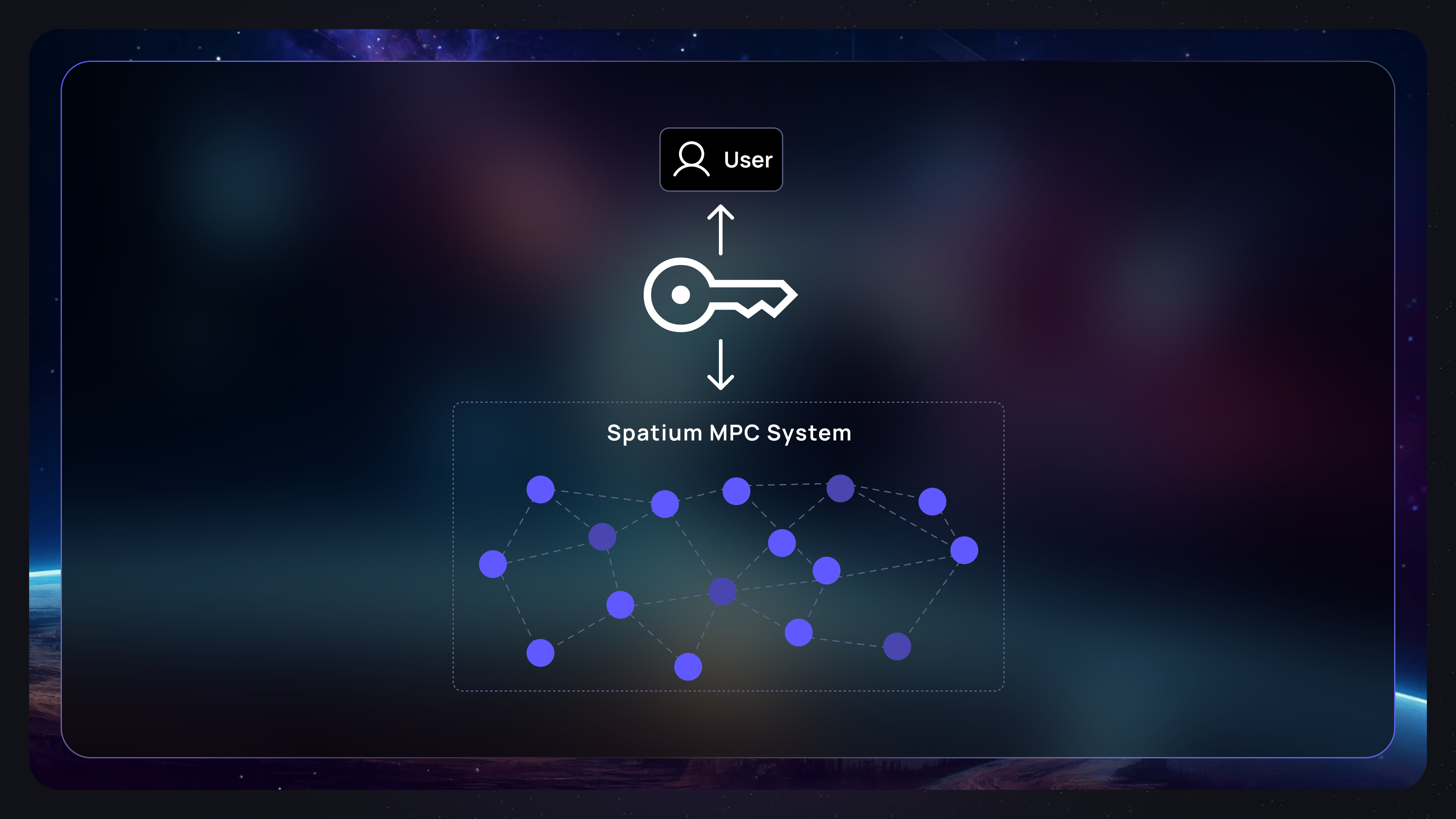

In one of our articles, we have already discussed a variety of benefits MPC encryption technology offers to crypto wallet service providers. One of them is the increased security of the crypto custody solutions powered by MPC. The reason is the absence of the private key, which is substituted with the number of secrets shared across several parties.

In such a condition the hacking of the private key does not make much sense because, for a bad actor, the task has become much more complicated. To get access to the digital assets, they have to hack the wallet, the service provider platform, the wallet provider platform, and any other platforms that could be storing the unlimited amount of secrets used to generate the private key.

2. Increased Control

Self-custodial wallets service providers do not need to align with governmental regulations, because there are no digital assets stored on their sides and this is one of the biggest benefits of this type of crypto custody solutions.

The full control over the assets is on the side of the user and the service provider only helps to safeguard the account and assist in its restoration in case the user loses access.

3. Cost Effectiveness

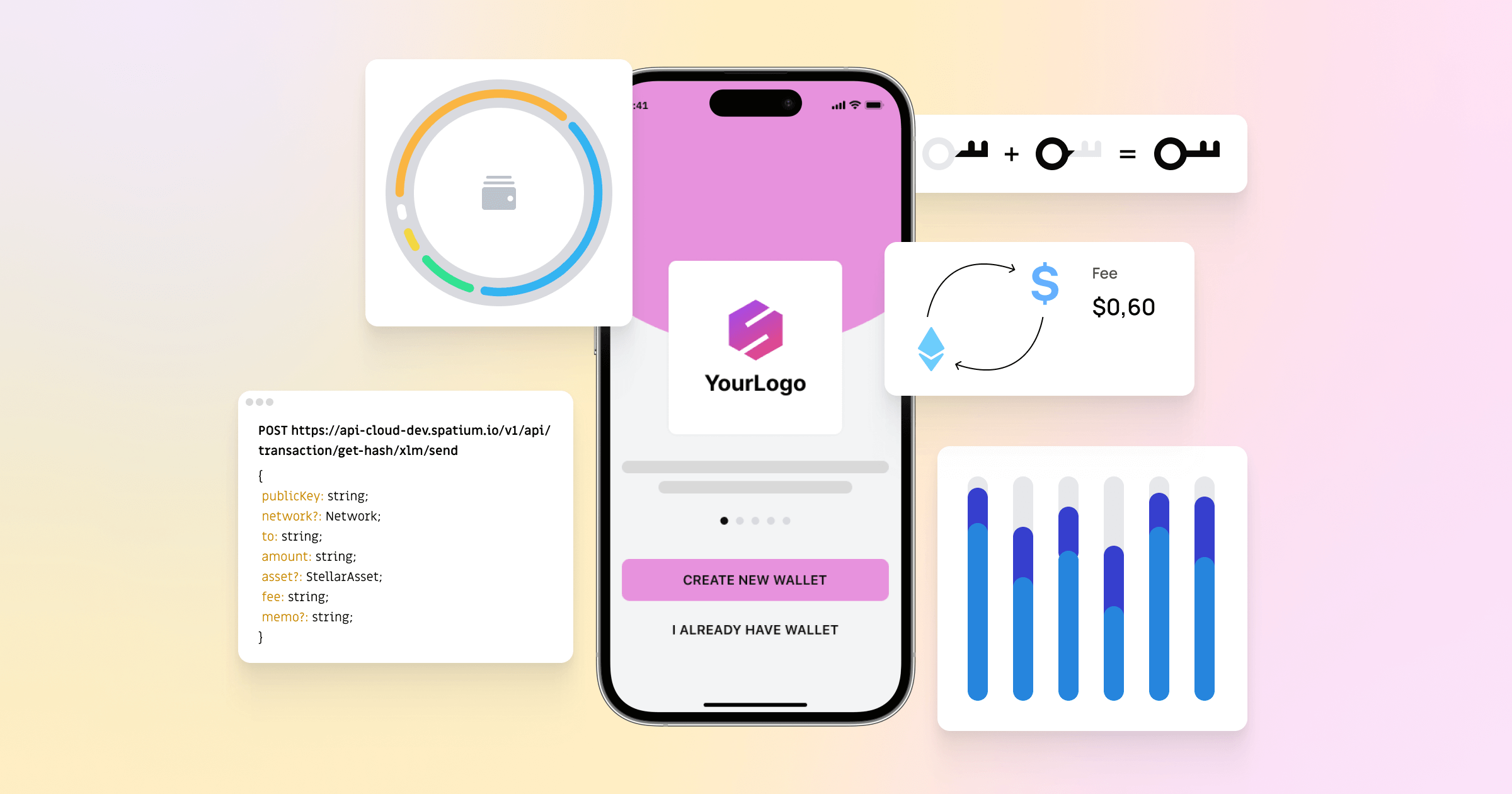

Businesses have to pay the fees to the crypto custody provider for wallet management. The bigger the business grows, the higher the fees are. The ideal solution for businesses is a self-custodial Wallet as a Service SDK, which is easy to use and allows building secure wallets with a meager budget.

4. Flexible Governance

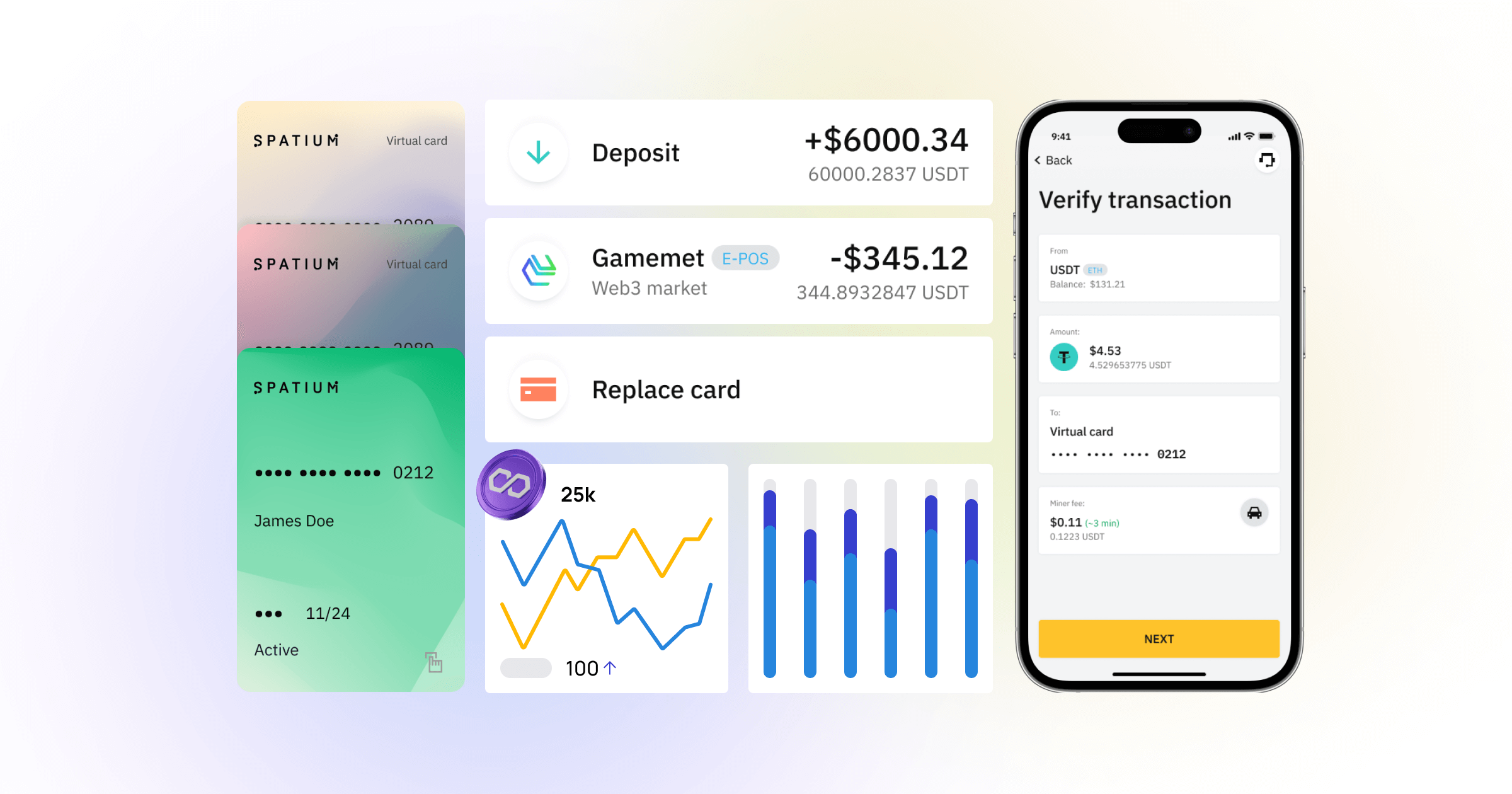

MPC-powered wallets that are self-custodial crypto solutions allow the introduction of various policies enhancing the control over users’ financial flow. As an example, it could be the introduction of the daily limit for transactions, notifications of any suspicious activity on the account, or any other management.

5. Greater Privacy

Unlike custodial wallets when all financial transactions are known by the custody provider, self-custody provides businesses with much greater privacy. All transaction data stays on the side of the business and that’s why it’s better protected.

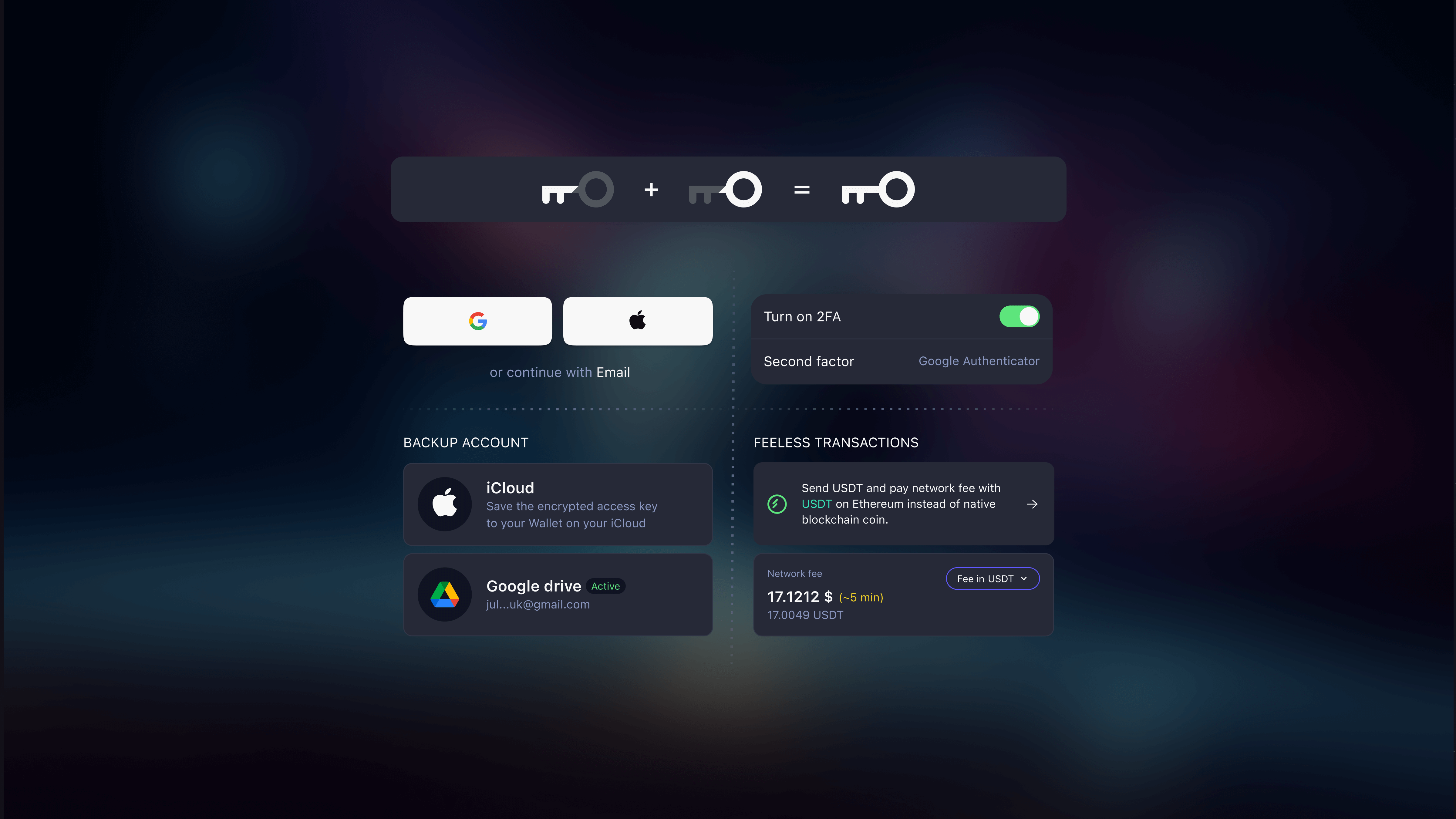

6. Convenient Interface

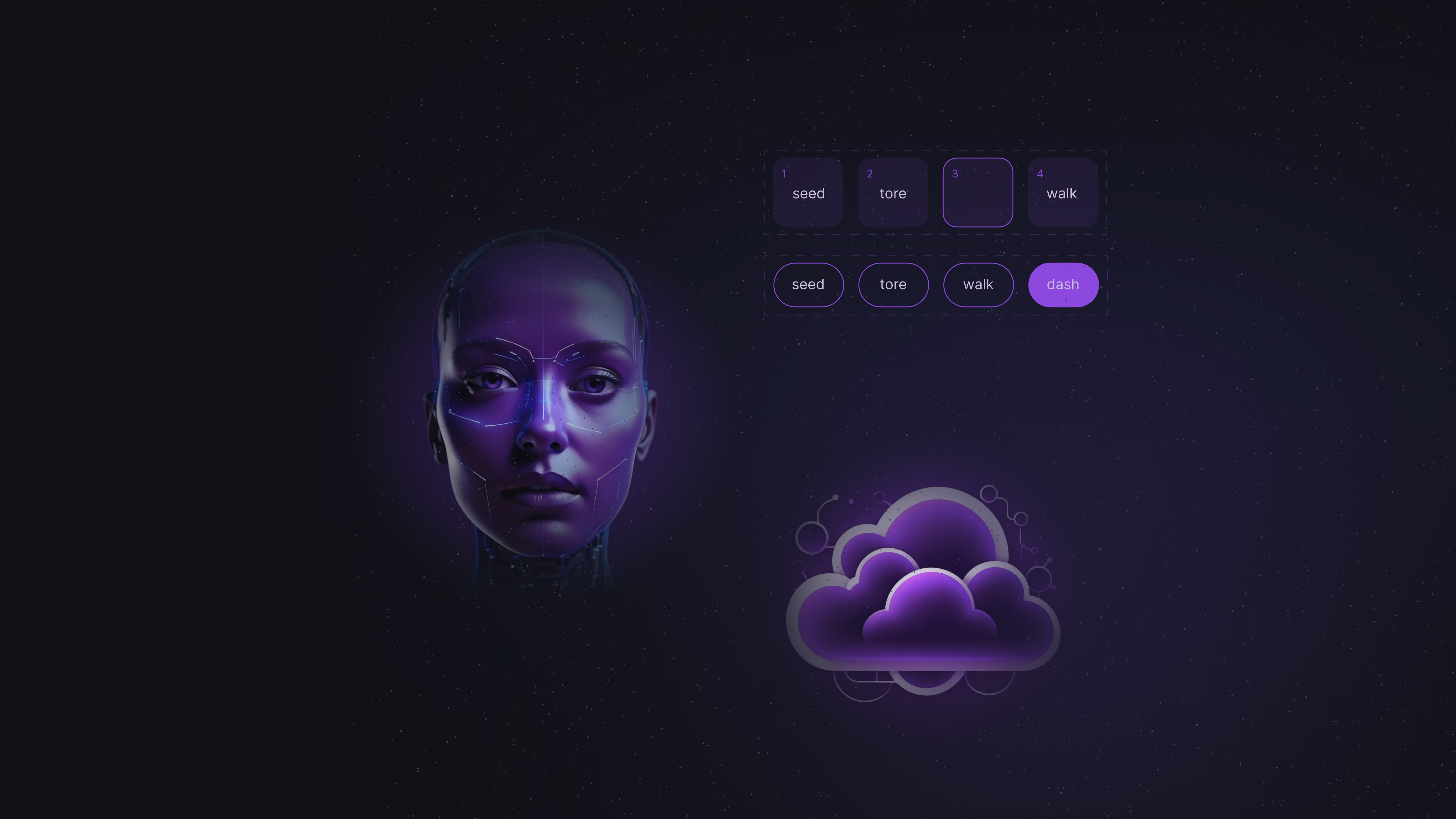

Until recently, self-custodial solutions were super secure but not very convenient for inexperienced users. With the MPC encryption technology, the situation changed. Modern MPC-powered crypto custody solutions are engaging and extremely user-friendly.

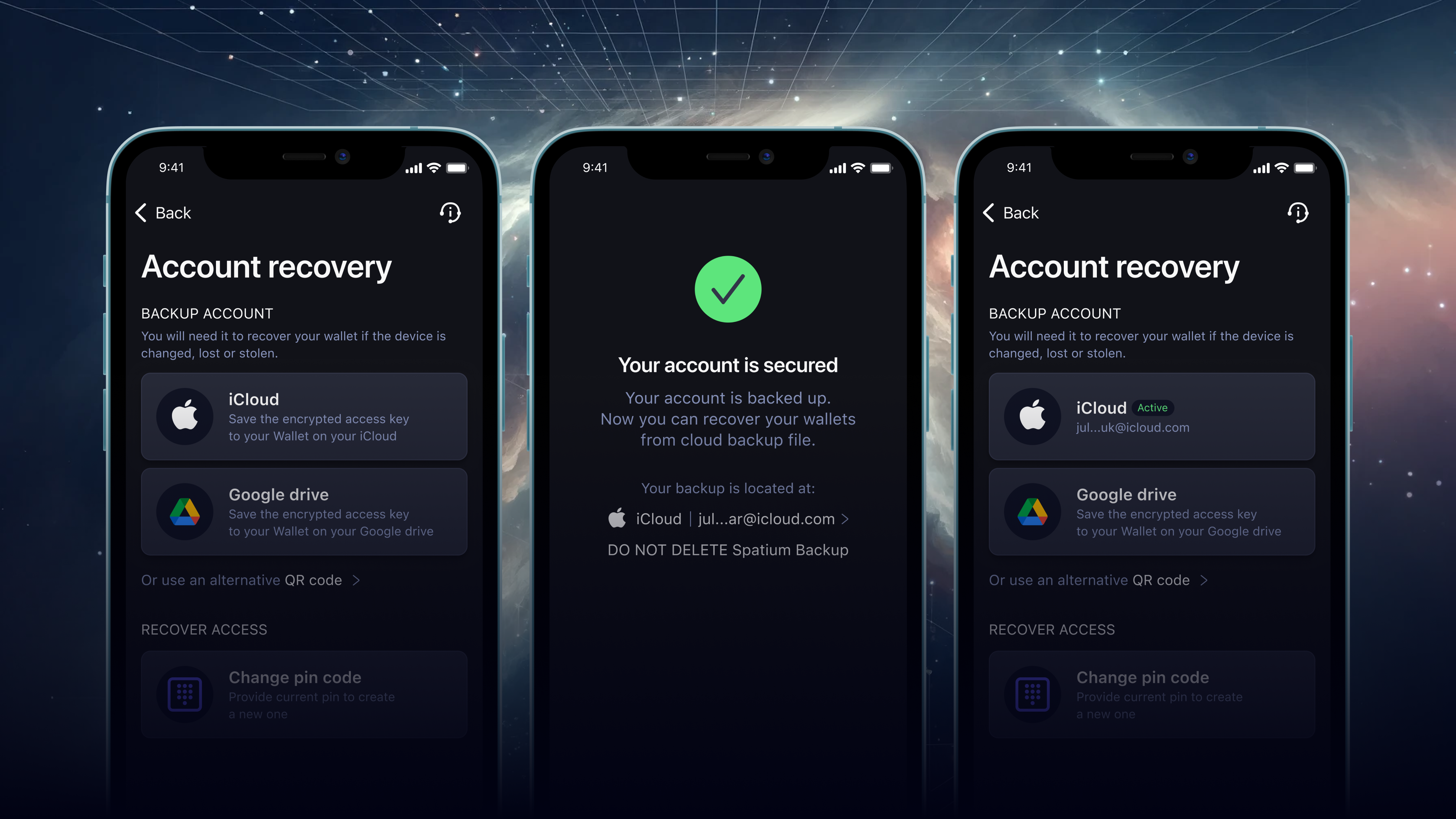

Anyone, who has any experience of interaction with web2 digital wallets, will feel no difference while shifting to web3 wallets. Advanced MPC technology made it possible to eliminate seed phrases through storing secrets used for private key generation in the encrypted cloud and the introduction of biometric backup.

Conclusion

It’s important for businesses to choose the right kind of crypto custody and the type of wallet. The wallet is the key element of users' interaction with the blockchain ecosystem and to get customer appreciation it should be well-protected and easy to operate.

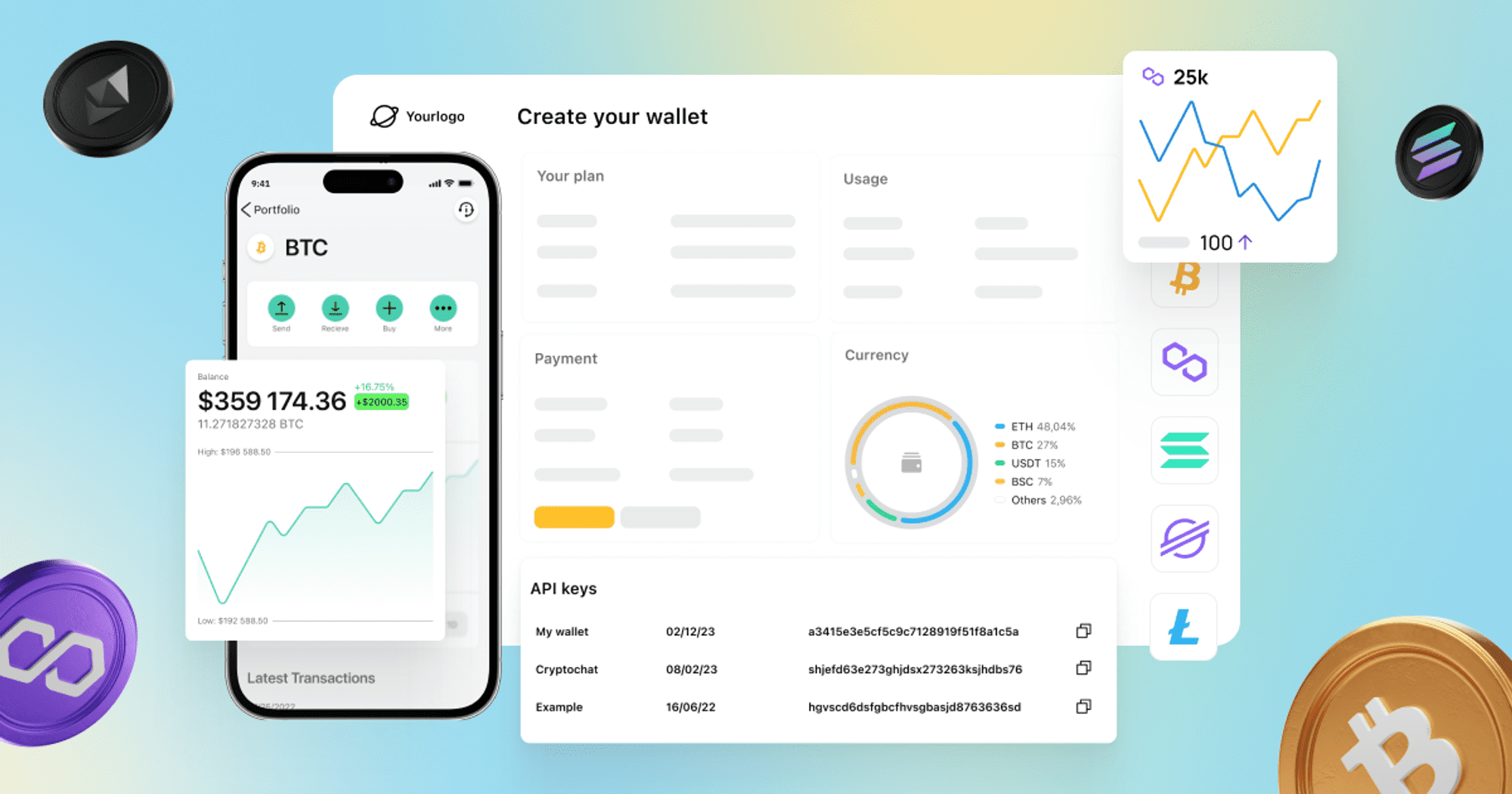

Spatium has revolutionized the wallet space by bringing to the market a highly competitive wallet powered by non-custodial WaaS SDK that is engaging and user-friendly and at the same time does not compromise users’ privacy and ability to fully control their digital assets.

Moreover, Wallet as a Service SDK offered by Spatium saves much time and effort, in addition to being financially beneficial. There is a very small learning curve involved before companies can start integrating Spatium institutional crypto custody wallets into their business processes.

To make sure Spatium is the right partner for you - send us a line and let’s discuss what are our touchpoints and how our technologies could help you nourish your businesses.

Share this

Subscribe by email

Related posts